Niva Bupa health insurance claim settlement process?

As you all know, health insurance is a basic necessity in today’s world because it helps provide financial protection in the event of medical emergencies. At today’s time, Niva Bupa is a well-known company in the field of health insurance that emphasizes providing health insurance, providing various plans to customers according to their requirements and necessities, and offering various insurance plans.

However the value of any health insurance is measured during the time of claim settlement process, when there is a most requirement of health insurance to cover the medical treatment.

What are the key features to consider in a Niva Bupa health insurance policy?

- They have more than 30,000 agents across all of India who help provide Niva Bupa health insurance plans to people.

- Niva Bupa health insurance plans provide cashless treatment because they have partnered with more than 13,000 hospitals all over India.

- Out of 10 by 9, they settle cashless claims within 30 minutes, which is a very good way of providing claims during medical emergencies.

What is the Niva Bupa health insurance claim settlement ratio?

The “claim settlement ratio(CSR) is a number that provides information about how the company handles claims. It will show the claims percentage, which is how many claims the company has approved and settled, as compared to the number of applications for the claims they received during a specific time interval.

Let’s understand this by an example: if a company received 100 claims application forms within 1 month,. If the company approves 70 claims, then the claims settlement ratio of the company would be 70%. It means that the company had successfully handled 70% of the claims.

The remaining 30 claims that are not approved could be for the following reasons:

1) Pending claims:

These claims are still being processed by the company and haven’t been resolved yet.

2) Rejected claims:

These claims are not approved because they do not meet the company’s criteria or policy criteria for approval.

At the end, it means that the ratio of the claim settlement is higher, which indicates, which is a good and trustworthy sign towards the company that the company helping their customers at tough times by being efficient in approving and paying the claims.

The information we got was through the website “www.renewbuy.com“.

Niva Bupa Health Insurance says they have settled 91.6% of the claims and have a 10,000 pan-India network of hospitals; they have a 24×7 dedicated relationship manager; they provide 30-minute cashless claim processing; and they have 1 crore+ trusted happy customers.

The information we got was through the website “www.nivabupa.com.“.

Ground reality check of the Niva Bupa Health Insurance Claim Settlement Ratio:

Now take a deep dive into what’s actually the ground reality of the Niva Bupa health insurance claim settlement process through the reviews of people on the Niva Bupa health insurance claim settlement process on social media platforms.

Now talk about the review on social media platform Reddit:

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

by from discussion

inIndiaInvestments

Comment

byu/Budget-Rip2935 from discussion

inpersonalfinanceindia

Comment

byu/Budget-Rip2935 from discussion

inpersonalfinanceindia

Comment

byu/Budget-Rip2935 from discussion

inpersonalfinanceindia

Through all these embedded posts, it looks like you are trying to find the mermaid around your home’s pond, and similarly, you are looking for good reviews about the Niva Bupa health insurance claim settlement process.

There might be 1 or 2 good reviews about the Niva Bupa health insurance claim settlement ratio, but most of them are bad reviews considering the worst user experience that was provided to them by Niva Bupa Health Insurance during the claim settlement process, as these are the information provided on the social media site by user’s whom I don’t know and don’t believe in their credibility.

The decision should be based on your thought process, and if you consider these comments to be truthful and insightful, having trust in these social media platforms, and they are providing the correct information, then you must withdraw the decision to take this policy because it can become worse and worse for you, according to the above review of people who are giving you information about the policy.

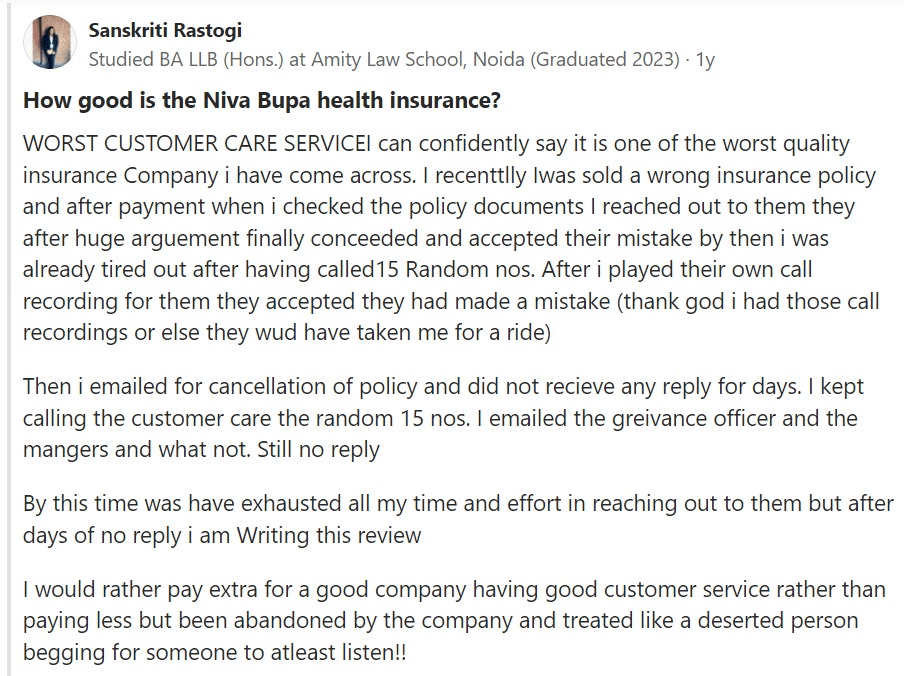

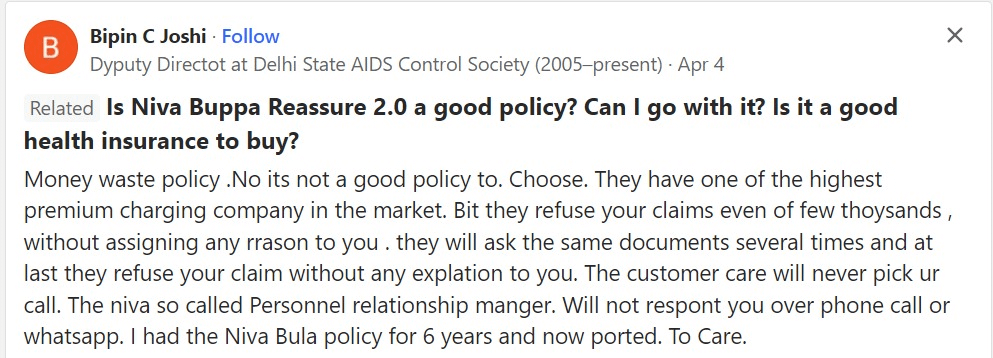

Now talk about the review on social media platform Quora

Here also, people can’t get a good response or experience with the Niva Bupa health insurance claim settlement process because all the reviews posted about the Niva Bupa health insurance claim settlement process are negative, so if you are seriously thinking of buying Niva Bupa health insurance, you should consider these reviews again if you have trust in these social media platforms. But if you still buy after reading all the reviews and posts, it would be the timeline where you are considering cutting your legs through your axe.